Virtual Private Networks Ensure Secure Mobile Banking

Mobile banking has become essential for everyday transactions, but it exposes users to cyber risks. Virtual Private Networks (VPNs) provide a shield by encrypting data and hiding IP addresses. This ensures that sensitive information stays protected during online banking on mobile devices. VPNs create a secure tunnel, preventing hackers from intercepting personal details like passwords or account numbers. As cyber threats grow, using a VPN is crucial for anyone handling financial activities on the go. It offers peace of mind and helps maintain privacy in an increasingly digital world.

Understanding VPN Technology

VPNs work by routing your internet traffic through an encrypted server. This process masks your real location and secures data transmission. For mobile banking, it means your bank’s app communicates safely. Hackers often target public Wi-Fi, but a VPN blocks these attempts effectively. Moreover, it ensures that all transactions remain confidential. Users can access banking services without worrying about data breaches. This technology is straightforward and compatible with most devices. In essence, VPNs add a vital layer of protection for daily financial activities. Therefore, integrating a VPN into your routine enhances overall security measures.

Benefits of VPNs for Mobile Banking

VPNs offer multiple advantages that bolster mobile banking security. They encrypt your connection, making it nearly impossible for cybercriminals to steal information. This is especially useful when traveling or using unsecured networks. Additionally, VPNs allow access to geo-restricted banking features securely. However, they also reduce the risk of identity theft during transactions. With VPNs, users enjoy faster and more reliable connections in some cases. Furthermore, these tools help comply with banking regulations by maintaining data integrity. Overall, the benefits extend to better performance and enhanced user confidence in mobile finance.

Overcoming Common Security Challenges

Mobile banking faces threats like phishing and malware attacks daily. VPNs counteract these by providing robust encryption protocols. For instance, they prevent man-in-the-middle attacks on public hotspots. Moreover, VPNs hide your online activities from prying eyes. This protection is crucial for avoiding unauthorized access to bank accounts. Users can bank remotely without constant fear of breaches. Therefore, adopting a VPN minimizes vulnerabilities in everyday scenarios. In a world full of digital risks, it serves as a reliable defense mechanism.

Why NordVPN is a Great Choice

NordVPN stands out for secure mobile banking due to its strong encryption and vast server network. It offers user-friendly apps that ensure easy protection on any device. This makes it ideal for beginners and experts alike. Moreover, NordVPN’s features like double VPN add extra layers of security. Choose NordVPN today to safeguard your finances and enjoy peace of mind. Sign up now and experience top-tier protection for all your mobile banking needs.

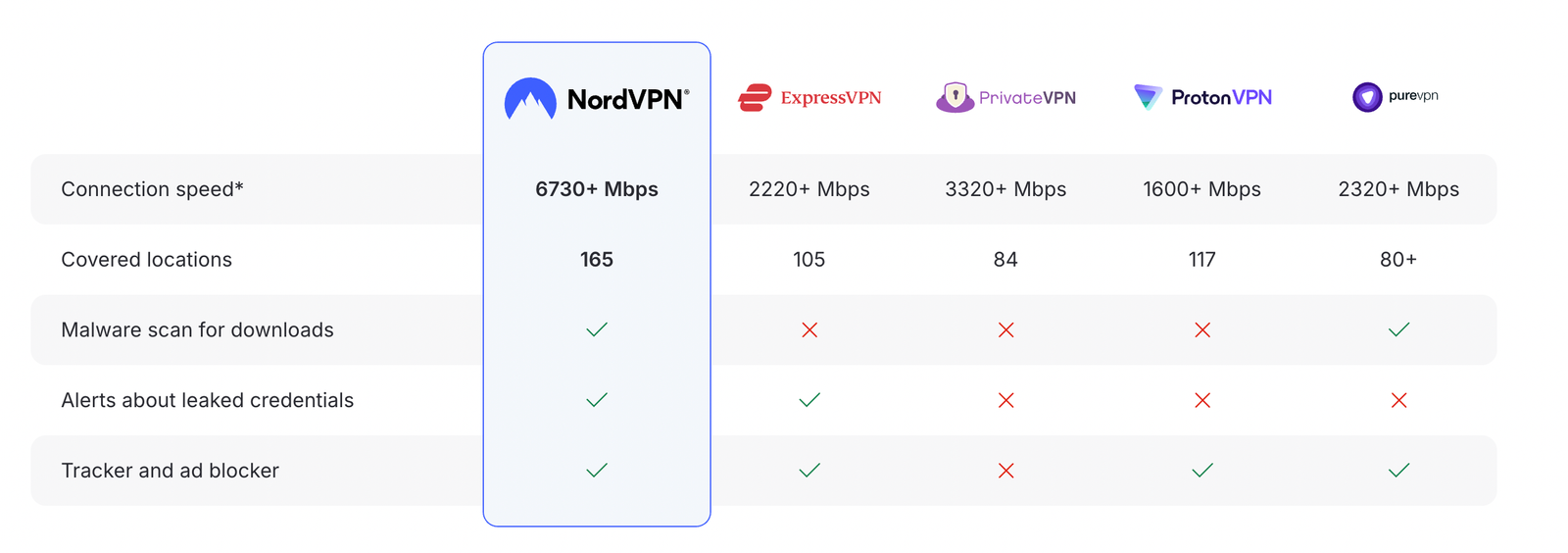

How NordVPN compares to other top VPNs

Disclosure: We earn a commission at no extra cost to you if you make a purchase through links here. This helps support us in creating more content for you. Thank you for your support!